CLIENT CASE -

Hotel & Resort – Financial Distress

Shareholders Nationality: Turkey Country of Operation: Eastern Europe - Seaside resort

Case Study background:

A Large luxury hotel in an Eastern European Seaside resort, has entered into a financial distress situation. The hotel was newly built (3 years), but not fully constructed and was a part of very large development that was planned. In 3 years of operation, the success rate was very low along with a very negative brand reputation from the clients, due to bad service, low quality management, food & beverage problems, etc.’.

All of these challenges, led to a financial crisis, suppliers demanding their payment and inability to continue the operations due to major cash flow issues.

The Challenges:

-

Inability to proceed, due to the financial obligations and no available investment funds.

-

The current hotel management, which led the process, wasnot suitable to lead the project and the company.

-

Low reputation and client's negative reviews.

-

Having no possibilities to continue the construction and finalize the entire resort.

-

Overdue bank loans which were not paid, created a daily stress by the creditors.

Goals:

-

Goal 1 – evaluating the entire financial situation, creating an immediate operation plan and execute it.

-

Goal 2 – replacing the hotel management and find new high skilled personnel.

-

Goal 3 – Analyze the client feedbacks and create a new organization plan for the entire departments.

-

Goal 4 – targeting the continuance of the work, without disturbing the current clients

-

Goal 5 – reducing the bank stress by achieving a “grace” period from the creditors.

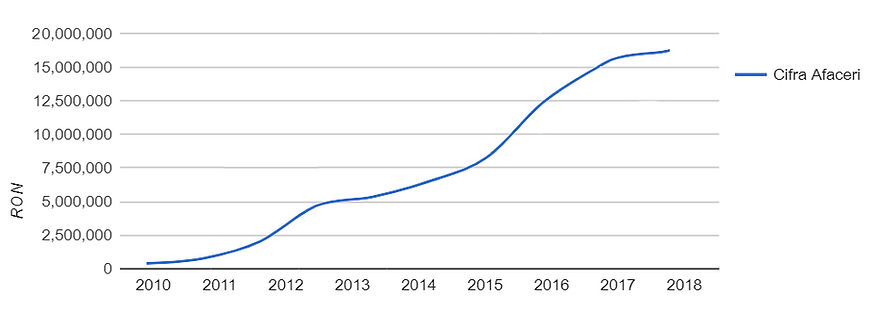

Results:

-

An emergency financial recovery plan was developed, presenting the targets of the project and the cash flow that will be resulted from it.

-

We have met personally, each one of the suppliers, presenting them the progress and having their signed agreement in providing longer periods for paying the open debts. These agreements gave the hotel management a “clear mind” for proper operation and recovery.

-

A new management plan and operation protocols were developed, based on the clients reviews. Departments were re-organized and followed by the new operation path.

-

The bank was presented with the new operation plan and financial plan. We presented how the loans taken will be supported by the company and agreed on 2 years grace (loan payment freeze for 2 years)

-

A full year operation plan was developed with new attraction (not only summer time as it was before). This injected money into the system all year round.

-

The construction works were done in stages, using special solutions in order not to disturb the client.

MCBA team did a great job in identifying several important action points to improve our financial performance.

They immediately identified the problem and the challenges, providing on-spot proactive solutions to overcome them. Operating fast and under extreme time pressure, they managed to get the work done perfectly

Ahmet Demir - Owner